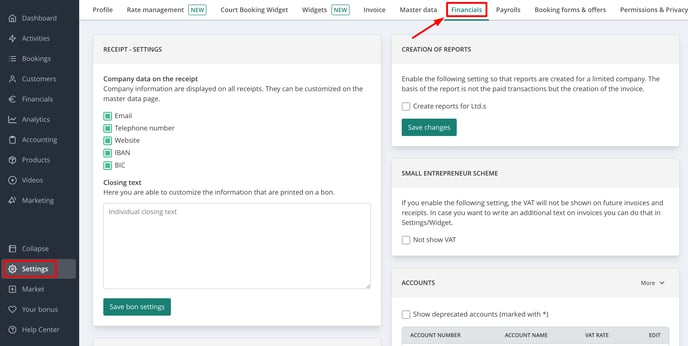

Financials Settings

All necessary information about receipts, creation of reports, accounts and invoice cycles

To begin, navigate to the menu item Settings > Financials.

1. Customising Printed Receipts

Note: This step is only necessary if you use a receipt printer to provide printed receipts to customers.

Customisation Options:

-

Company Information: Displayed at the top of the receipt. Ensure your company details are correctly entered under Settings > Master Data.

- Closing Text: Add a custom message at the end of the receipt.

-

Receipt - logo: Upload your company logo to personalise the receipt.

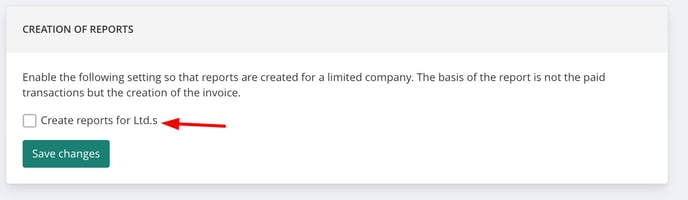

2. Creation of reports

If your business operates as a limited liability company, enable the corresponding option to generate reports tailored to this company structure.

Important: If you run a small business and are exempt from displaying VAT percentages on your invoices, please contact Eversports Support at support@eversports.com to adjust your settings accordingly.

3. Configuring VAT Accounts

Eversports Manager provides three standard accounts, each linked to a specific VAT rate.

Setting Up Accounts:

- Consult with your tax advisor to determine if additional accounts are necessary (e.g., a separate account for membership revenues).

- To add a new account, click the More > New button. To edit an existing account, use the pencil icon.

- Assign each product to the appropriate bookkeeping account to ensure correct VAT application.

Proper account configuration ensures accurate financial reporting and compliance with tax regulations.

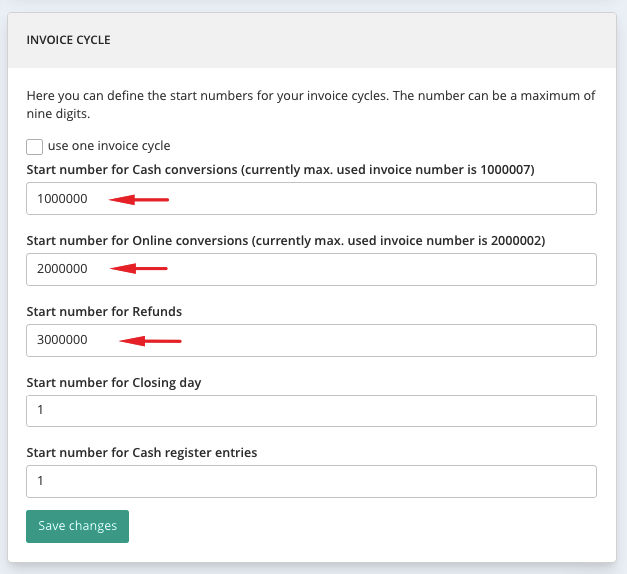

4. Managing Invoice Cycles

Each invoice generated by Eversports automatically receives a sequential invoice number.

Important: Once you have made your first sales, you cannot set the invoice cycle to a number lower than the last issued invoice. Please ensure that your invoice cycles are configured correctly before processing your first sales.

Recommended Invoice Cycles:

-

1000000 – Onsite Transactions: For sales processed through the Eversports Manager (e.g., cash, bank transfer, credit/debit card on site).

-

2000000 – Online Transactions: Invoices that result from online purchases. These invoices are created by Eversports in your name and therefore have their own invoice cycle. Examples: PayPal, credit card etc.

-

3000000 – Refunds: For cancelled transactions. Each refund will receive a unique invoice number, regardless of the original payment method.

-

1 - Closing day

-

2 - Cash register entries

Why do we recommend this?

In case of questions from your customers, you can immediately recognise the type of transaction by looking at the first digit.

Use a Single Invoice Cycle

You can also combine onsite sales and online sales within the same invoice cycle.