Creating a Credit Note

When to Use a Credit Note

If you need to refund a customer but cannot cancel the original invoice—perhaps because it’s older than 90 days or due to specific payment methods (i.e. SEPA Online) — you can issue a credit note with a negative amount.

This negative invoice adjusts your accounting records and facilitates the refund process.

1. When to create a credit note

Create a credit note in the following cases:

- ✅ Automatic SEPA debits were successful:

These cannot be refunded directly. If you attempt to refund, the customer might still issue a chargeback, resulting in a double refund. - ✅ Online invoices older than 90 days:

Refunds cannot be issued through the payment provider after this period.

- ✅ Partial refunds needed:

You can only partially refund an invoice by issuing a credit note.

2. How to Create a Credit Note

2.1. Create a New Article:

- Go to Products > Articles.

- Click on Add Article.

- Name the article (e.g., “Credit Note” or “Refund”).

Go to the menu Products > Articles and create a new article.

You can name the article "Credit note" or "Refund" for example.

2.2. Set the Amount and VAT:

- Enter the refund amount as a negative number (e.g. -€50.00).

- Select the same VAT account used in the original sale.

2.3. Sell the Article to the Customer

- Navigate to Financials > Selling.

- Select the customer to be refunded.

- Add the credit note article and choose the appropriate payment method (e.g. Bank Transfer or Cash).

- You can adjust the amount again before finalising the sale.

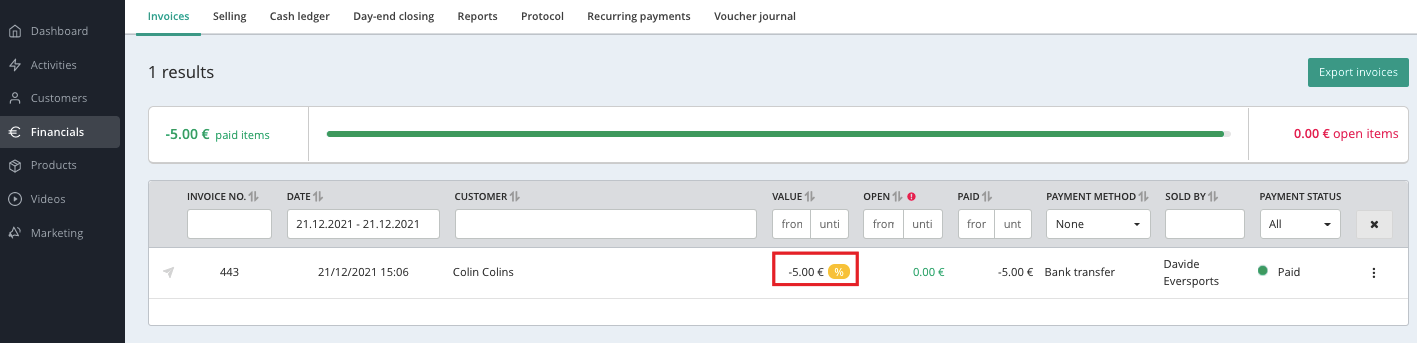

- The system will automatically generate a negative invoice.

3. Transfer the Refund

Once the credit note is created, manually transfer the refund amount to the customer’s bank account or refund them in cash, depending on the selected payment method.