Automated SEPA online

How automated SEPA online works with Eversports Manager

What is automated SEPA online?

Automated SEPA online is a European payment method which allows you to deduct recurring (membership) fees from your customers bank accounts, after they have given you a single initial approval (SEPA mandate) to do so.

Your Eversports Manager will automatically plan and execute the payments for you, this way you don’t need to do anything manually anymore. It also updates the payment state of the invoices and informs you if a payment fails.

This will save you a lot of time, prevents that you miss income and makes a seamless payment experience for your customers.

How to activate automated SEPA online?

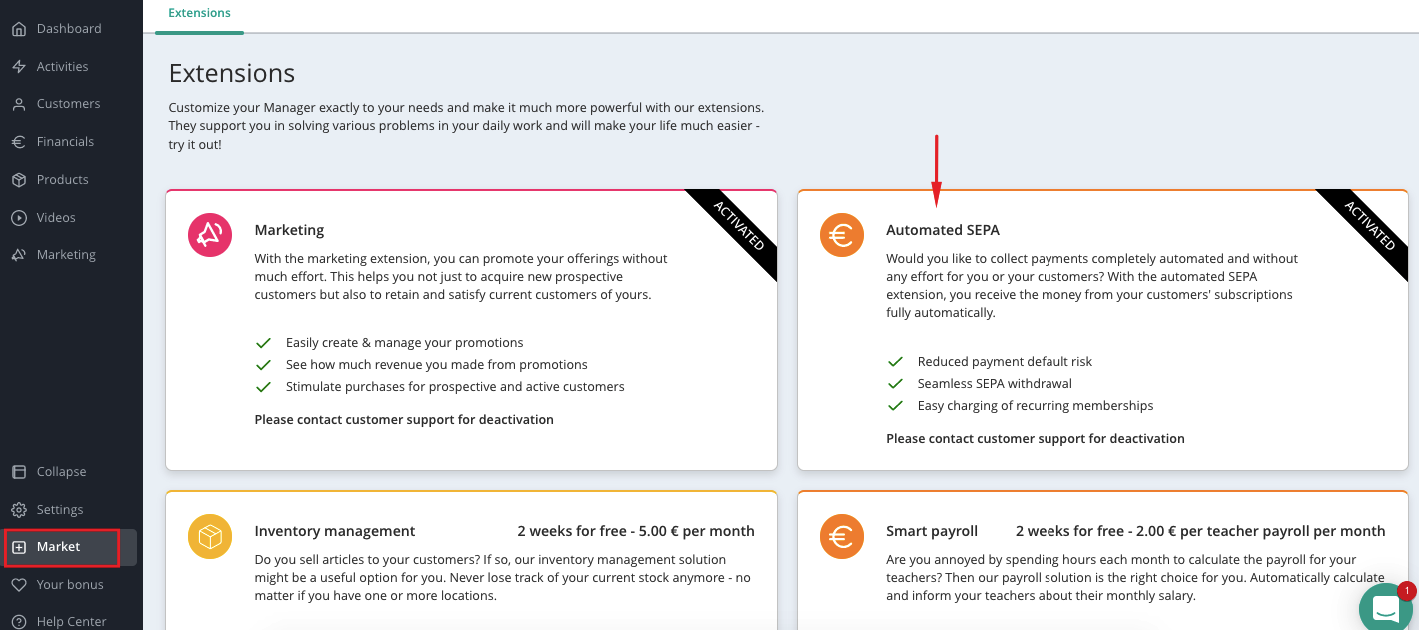

To use automated SEPA you can enable the extension Automated SEPA in the menu Market. Upon activation, new options and menus related to SEPA mandates and payments will become available in your Eversports Manager and your customers now have the option to select the payment method SEPA for online purchases.

Create and validate the SEPA mandate

In order to execute a SEPA payment on a customer’s bank account you need to have permission from the customer. This permission is called "SEPA mandate" and is made up of the name of the bank account holder and their bank account.

If the customer purchases the membership online, the SEPA mandate is automatically created online. You get a To Do in your menu Dashboard to verify it.

If you want to assign a membership to a customer manually in the Manager, you can enter the bank details in the customer profile to create the mandate.

Afterwards you need to validate the SEPA mandate. You can do this by sending a verification email to the customer or by verifying it manually.

Here you can learn how to create and verify a SEPA mandate for your customers.

IMPORTANT: Before you assign a SEPA mandate, you need to check if the customer has accepted your invitation. This is necessary for two reasons:

-

Technical requirement: so that our payment provider Stripe can charge your customers.

-

For communication purposes: When the venue confirms the mandate, Eversports Manager sends a notification to your customers that their membership will now be charged with auto-SEPA. It is important that your customer knows about this, because they will see a debit from Eversports in their bank account and may not trust that. This way we prevent and avoid chargebacks.

Assign memberships with automated SEPA online

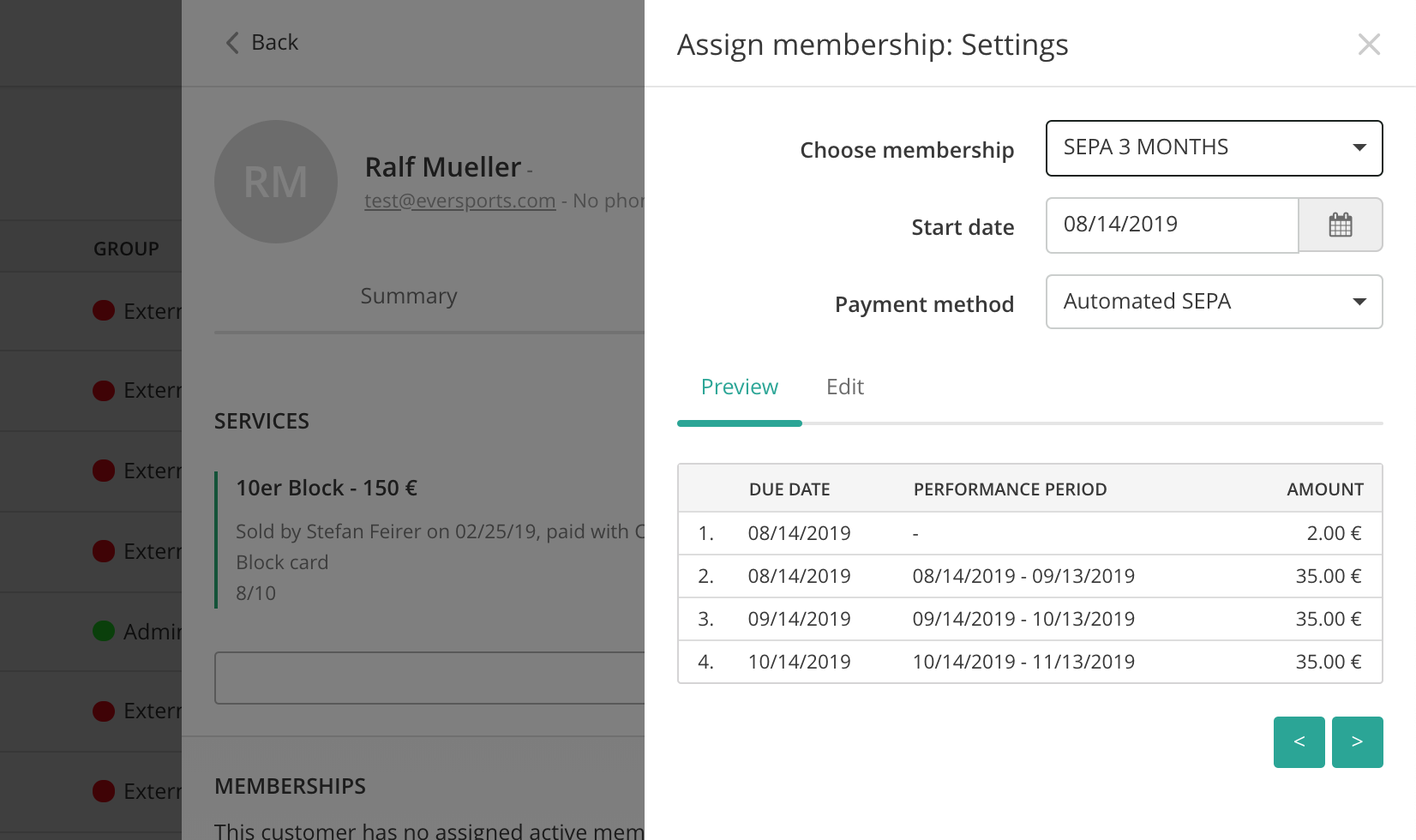

Once the SEPA mandate has been verified, you can assign a membership to the customer and select the payment method "automated SEPA".

Learn here how to assign new memberships to your customers.

Overview of invoices with Auto-SEPA payments

For each recurring SEPA payment, your Eversports Manager will create an invoice which you can follow in the menu Financials > Invoices. The payment state of the invoice is updated along with the status of the SEPA payment (planned, sent out, in process and paid).

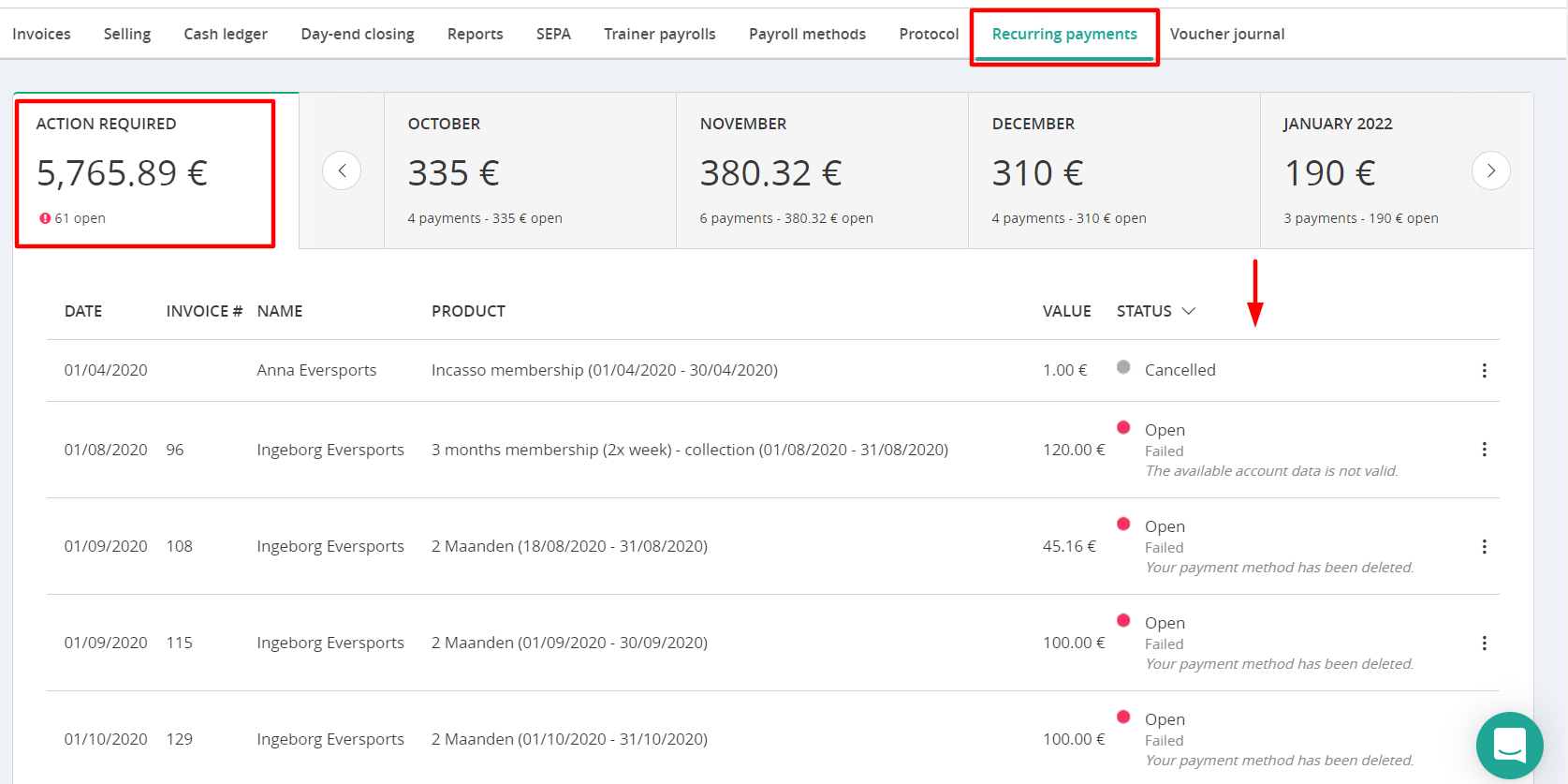

In the menu Financials > Recurring Payments you can keep an eye on all the payments of the ongoing memberships with auto-SEPA.

- Per month it is indicated how many payments there are, what total amount they represent and what amount is still open for that month.

-

You can look at the planned membership deductions for the upcoming months.

-

In addition, there is a separate tab with payments that require an action. Here the failed SEPA transactions are shown together with the reasons for the impossible payment (e.g. SEPA mandate not verified).

Note: SEPA Processing Time: SEPA payments typically take 5 to 10 business days to be processed after being initiated.

Check SEPA chargebacks

When collecting fees with auto-SEPA, return debits or chargebacks may occur. A chargeback is originated when an amount collected with SEPA direct debit is debited back to the customer.

This can happen, for example, due to insufficient funds in your customer's bank account or due to incorrect bank details or at your customer's request. For the latter, the customer must submit a chargeback request of the debited amount to their own bank.

SEPA transactions where a chargeback took place can be identified by the red dot and the payment status Open (Failed)

If an automatic SEPA debit fails or is charged back, you can then retry the SEPA debit or indicate that the amount will be paid in another way (i.e. cash, bank transfer).

Learn here more about chargebacks and how to check them.

Comparison of online purchase and manual assignment of memberships

| Online | Manual |

| Start date on purchase date | Membership start date flexible |

| Mandate creation online by customer | Mandate confirmation by customer via e-mail or manually by studio |

| No Admission fee possible | Admission fee possible |

| Invoice history viewable in the profile | Invoices can be sent on request |

| Cancellation by customer or studio possible | Cancellation only manually by studio |