Exporting Financial Reports

Learn about the various financial reports available for export.

This article helps you understand which financial reports are available in the Eversports Manager, how to access them, and which ones are relevant for your business operations, tax reporting, and internal analysis.

Tip: If you want to find an overview of your Eversports invoices, payout journals and transactions fees, you will find this in the tab Billing.

1. Accessing Financial Reports

1.1. Financials > Reports (outdated)

-

Navigate to Financials > Reports in your Eversports Manager

-

Select the desired timeframe on the right-hand side (e.g., one month).

-

Choose the type of report you wish to export.

1.2. Analytics > Reports (new)

To find a more extensive overview of all our reports, we recommend you have a look at the tab Analytics > Reports. Here you will find the newest financial reports as well as an overview of the activity, customers, product, marketing and videos exports.

Just click on the respective report:

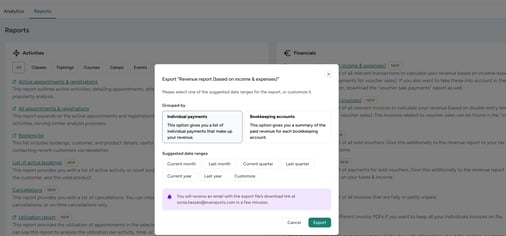

- For the new reports, a window will open directly where you can choose to download it grouped by individual payments or bookkeeping accounts and the time frame:

- For the others (with an arrow next to the name) you will be directed to the area in the manager where you can download the reports.

Tip: You can give your tax consultants access rights, so he can have an overview of all reports. Give log-in rights.

2. Types of Financial Reports

2.1. New Reports

The new reports are the reports, you will only find in the tab Analytics > Reports.

Tip: We recommend this FAQ Article to better understand your revenue with the new financials reports

Here the overview of this reports:

- Revenue report (based on income & expenses):

This report gives you a list of all relevant transactions to calculate your revenue based on income-expense calculation (apart from payments for voucher sales). If you also want to take these into account in the income and expenditure calculation, download the "voucher sale payments" report as well.

- Revenue report (based on invoices):

This report gives you a list of all relevant invoices to calculate your revenue based on double-entry bookkeeping (so excluding invoices for voucher sales). The invoices related to voucher sales can be found in the "voucher sales" report.

- Voucher sales report:

This report gives you a list of all sold vouchers. Give this additionally to the revenue report to your tax advisor to report on your taxes & income.

- Voucher sale payments:

This report gives you a list of payments for sold vouchers. Give this additionally to the revenue report to your tax advisor to properly report on your taxes & income.

- Unpaid invoices:

This report gives you a list of all invoices that are fully or partly unpaid.

2.2. Existing Reports

These reports can be found in other tabs (e.g., Finance, Vouchers), and here you'll find an overview of all available reports:

- Invoice Report:

Here you can export all invoice PDFs if you want to keep each invoice individually. - Cash Ledger:

Get an overview of the day's cash transactions with information about the cashier, payment method, etc. More information here. - Cash Transactions:

Find all customer and revenue details related to the cash transactions of the day. - Day-End Closing:

If you need an end-of-day closing specific to your cashbook, you can find it here. More information here. - Payment Methods & Cashier:

This report is generated based on the transaction date of your sales. It provides an overview of sales per employee and payment type. It is NOT relevant for accounting but can be used to analyze business operations. - Product Sales & Discount - Overview:

Here you can see which products generated how much revenue and what discount was applied. It facilitates individual analyses and can be exported as PDF or CSV. - Product Sales & Discounts - List:

This report is generated based on the transactions date of your sales. It shows which products werde sold (paid and unpaid) and in which quantities, including applied discounts. You can export it as PDF or CSV for further individual analysis. - All Payments:

Here you get a list of all payments with all related payment information, such as invoice number, product information, and customer details. This report is based on the transaction dare of your payments. The CSV lists every payment made within the selected period. - All Invoices with Payments:

With this export, you get a list of all invoices containing invoice-related information such as revenue, payments, and customer details. This report is based on the invoice issuance date for all created invoices (paid and unpaid) within the selected period. You can forward it you your accountant every month.

2.3. Other Reports

- Payroll Slips:

Here you can get a list of payroll slips created for your staff in a specific month. You can only view this export if you have activated the Smart Payroll extension. More information here. - Protocol:

Here you can export the cash register protocol, which documents changes related to payments. More information here. - Created Vouchers:

If you want to know which vouchers were sold and related sales information, you can export this list. More information about vouchers here. - Voucher Redemption:

Get a list of all voucher redemptions within a specific period, including all relevant details.

3. Why do my exports NOT match each other?

Eversports Manager offers various types of exports that serve different purposes and are based on different calculations.

These differences represent necessary information for your accountant.

Make sure not to compare numbers across different export types, as by nature, they will not match.

Example: The "Revenue Report (based on invoices)" is based on the invoice data (when the product is sold), while the "Revenue Report (based on income & expenses)" is based on the transaction date (when the product is paid). These reports rely on two different calculations and cannot be compared.

4. Exports for Limited Liability Companies

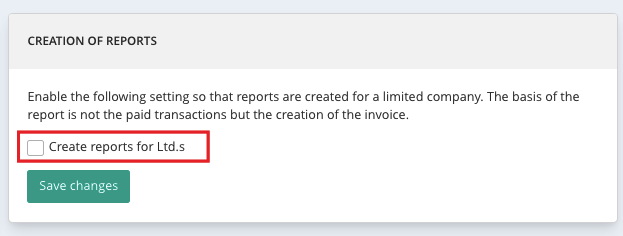

If you are a limited liability company, your financial reports must show all invoices - paid and unpaid.

To create the correct reports for your company type, go to Settings > Finance > Creation of Reports and select the corresponding checkbox.

Important: If you are a small business and do not need to display VAT on your invoices, contact Support. We can adjust this for you.